Peek Looks To Cheap Smartphones, Connected Devices For Future

From the moment Peek debuted on the market, skeptics have wondered what the future was for a dedicated e-mail and text device in the era of smartphones. But the company has built a very modest, nearly profitable business — 50,000 units sold in two years — with its low-cost messaging handsets and is increasingly selling them to companies in need of connected devices for workers.

From the moment Peek debuted on the market, skeptics have wondered what the future was for a dedicated e-mail and text device in the era of smartphones. But the company has built a very modest, nearly profitable business — 50,000 units sold in two years — with its low-cost messaging handsets and is increasingly selling them to companies in need of connected devices for workers.But while the New York-based start-up has yet to become a well known brand, the company believes its back-end technology, not its current end products, can position it for a break-out year. Peek is expanding to low-cost smartphones and potentially other connected consumer electronics devices. Rather than be swallowed up by smartphones, Peek is betting it could actually ride the same wave of mobility and connectivity to success with a product strategy change. It’s a hefty-sized wager, perhaps even a last ditch effort, but one that CEO Amol Sarva believes can pay off.

In a meeting I had with Sarva this week, he told me that in a year from now, the Peek devices and service plans, which currently make up a great majority of the company’s revenue, will become just 20 percent of the business as Peek’s software eventually powers dozens of devices around the world. Sarva said Peek has built its software to work on Qualcomm’s BREW platform and is also outfitted it to work on chips from MediaTek, a fabless semiconductor company. He also said manufacturers in Asia are now poised to use those components and build very low-end smartphones that leverage Peek’s messaging software and cloud service, which will sell in emerging markets such as India, Africa and Latin America. Sarva expects five Peek-powered phones to launch in the next month and 30 phones by this time next year.

While emerging markets are slowly embracing smartphones, Sarva said there will be a distinct need for ultra-cheap and simple devices that will sip power and be efficient with network resources, especially in areas that have yet to see 3G networks. He said Peek’s software, which is designed to work on very simple and inexpensive 100 MHz processors, allows manufacturers to build affordable smartphones that could retail for as little as $50 unsubsidized.

As we’ve written prior, many manufacturers are looking to the free Google Android operating system to build cheap smartphones. But the hardware requirements of Android are still more rigorous than commodity feature phones, so Sarva says there’s an opportunity to ship cheap, but competent, hardware using simpler processors and less expensive components. These could undercut prices of Android devices, while still providing more robust messaging and applications through Peek’s platform. The latest version of the Peek software can handle push e-mail, works in areas with poor or marginal cellular coverage, offers Facebook and Twitter integration, includes location support and has the ability to run light-weight Peektop apps.

“This is a huge opportunity for us,” Sarva said. “We’ve built technology that no one cared about but now we’re suddenly being approached by guys who have the hardware that want to make it smart.”

Even with Sarva’s optimism, the cards are still stacked against Peek in the long run. With more and more cheap Android phones on the way, Peek will be have to prove itself against an army of Google devices. And it’s a question if carriers will embrace Peek when they’re likely looking to sell more profitable smartphones and bigger data plans.

Sarva believes there’s also another big opportunity brewing in helping connect consumer electronics devices. He said Peek is talking to major CE brands about including Peek software in everything from photo frames and cameras to tablets, clock radios and MP3 players. He said companies are looking to leverage Peek’s work in connecting to cellular networks as a way to connect their devices.

He said by leveraging Peek’s simple software, electronics manufacturers can strike a blow against the increasing threat of smartphones by building in connectivity. “If you’re a camera maker, you can put in 3G and move in the direction of a phone,” he said.

The opportunity in what some call the Internet of Things will take longer to materialize, said Sarva, because CE manufacturers take more time to act. But he said that could also be a major part of Peek’s business in the years to come.

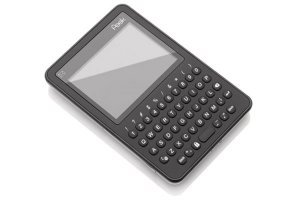

That doesn’t mean Peek is giving up on its small messaging device, the latest of which the Peek 9 rolled out in September. Sarva said the company has shifted its business away from consumers to corporate customers, who are looking to Peek to equip manual and remote workers with messaging tools. He said dozens of hotels are handing them out to the housekeeping staff to help them report their work progress while trucking companies are giving them to drivers. Some fast food chains like Panda Express and Sonic are also trying out the use of Peeks to track incoming orders.

He said even as the smartphone grows in importance, consumers are still holding on to existing devices like laptops and are adopting new ones like tablets. That, Sarva said, shows that people will be carrying multiple devices well into the future. And many service oriented-companies, in particular, may be inclined to rely on cheap messaging devices as essential tools for low-end workers.

Peek, which has raised $20 million to date, has always went against the grain, favoring simplicity (sometimes to an extreme) in an increasingly complicated world. This next phase, however, will be very telling for the company. If he’s right, Sarva will prove that the company can find a profitable niche for his software in a connected world. But the pressure will be on as Peek bids to become less of a simpler messaging service and more like the smartphones he’s been competing against.

Похожее

Android smartphones share in Russian deliveries reached a record-high 70.9%

The “Skolkovo” Fund gave grant for the project DO-RA development

Investments in mass media of the future

Google launches a paid music service Google Play Music All Access