Activity of venture capital in the second quarter 2013 has significantly decr

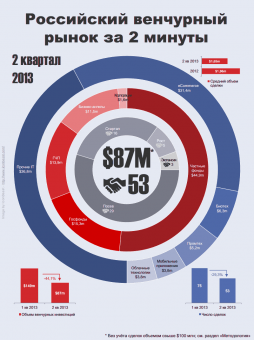

The total volume of venture financing in Russia in the second quarter 2013 comprised $87M, informs investment company “Rye, Man & Gor Securities”. This is 41,3% lower than in the first quarter 2013, and 74,7% lower than in the second quarter 2013. The amount of closed deals decreased up to 53. Volume of investments and amount of deals appeared to be very low for the last six quarters, say analytics.

The total volume of venture financing in Russia in the second quarter 2013 comprised $87M, informs investment company “Rye, Man & Gor Securities”. This is 41,3% lower than in the first quarter 2013, and 74,7% lower than in the second quarter 2013. The amount of closed deals decreased up to 53. Volume of investments and amount of deals appeared to be very low for the last six quarters, say analytics.Slowdown in the growth of economy in the first quarter 2013 influenced volume of venture financing, in Russia, Europe and USA, where market of venture capital has also decreased.

Herewith this decrease has other reasons. Thus, Russian venture market is quite close and information cloudy, this is why it becomes known about closed deals only after several weeks or months. Besides, parties often prefer not to disclose deal`s volume, and expert`s evaluation can significantly vary. Thus, real scale of a venture financing decrease in the second quarter 2013 most probably is lower, than it should be from the given numbers, suppose experts of “Rye, Man & Gor Securities”.

Decrease of amount of closed in the second quarter 2013 in comparison with the first quarter appeared mainly due to investments in a company, which is at a seed stage: amount of deals at Startups stages, growth and expansion in the second quarter 2013 decreased insignificantly (since 30 to 24), and deals at a seed stage have been executed significantly lesser (29 against 45).

Fall of seed deals` amount has not appeared on a volume of seed financing in money terms. Volume of attracted venture capital by Russian companies at a seed stage in the second quarter 2013 increased 9,3% in comparison with the first quarter, and comprised $17,2M.

In 2013 there is an expressed tendency to decrease of private and private-state investments in venture companies at a seed stage: share of private funds in the total volume of deals in the second quarter 2013 comprised 13,1%, meanwhile in 2012 in average in comprised 34%, and in the fourth quarter it reached 44,7%. The same tendency was with deals with Startups. This means that financing of new projects at a seed stage becomes responsibility of State funds.

IT still are the most favorable basis for venture projects. In the second quarter 2013 about 87% of all investments on Russian venture market appeared at IT-sector. Volume of capital, invested in industrial and biomedicine technologies for the last 5 quarters does not exceed 11% of the total amount of venture investments; herewith differences in preferences of investors are very noticeable: if in IT invest mostly private and corporate funds, then in industrial and biological technologies 70-90% of investments comes from State institutes of development.

Inside the IT-sector it is possible to reveal the most popular for investors’ sub-sector of e-commerce. Its share in investments, attracted by IT-sector in the last four quarters, comprises 41,8%.

It is also important to note the growth of a share, which comes to investments in sector of cloud technologies in the whole volume of venture financing (4,3% in the second quarter 2013 in comparison with 0,8% in the first quarter), and also decrease of investments volume in mobile applications since $41,3M (27,8% of all investments) to $3,8M (4,4%).

Volume of the average deal in the second quarter comprised $1,65M – a bit lesser than in the first quarter ($1,98M) and in 2012 ($1,96M).

Похожее

Russia?s 2Q 2013 venture investing down nearly 50% y-o-y, RMG reckoned

RMG analysts find Q3 ?most successful quarter? this year in VC invested and deals closed

U.S. venture capital market drops to 10-year low

RMG and EWDN report: Q4 most successful in 2013 at Russia?s venture transaction market

PwC and RVC introduce the Review of venture deals in IT over 2011

EY and RVC: Russian venture capital industry has grown tenfold since 2007